Istanbul Nears

Market participants are optimistic. Although the prices of digital assets are in a downtrend, threatening to further collapse as 2019 comes to a close, fundamental events could prop prices. Top of the list is what Ethereum developers are preparing for in the next four days or so at block height 9,069,000.

Successful implementation of the Istanbul hard fork will complete the Metropolis stage, a milestone and a vital upgrade that is core to the Ethereum roadmap, and marks the end of the last network improvement ever on Ethereum 1.

Subsequent hard forks pave way for Serenity and eventually Ethereum 2.0.

Difficulty Bomb Activation

On Dec 7, six EIPs will be activated and even though the cost of executing smart contracts will be higher, the network would better handle spam and DDOS attacks.

With Istanbul less than a week away, the developer community has also decided to delay the “Difficulty Bomb”, meaning miners now have a leeway to mine cheaply and without adjusting their hardware as the network’s difficulty is jerked up higher.

Mount Glacier is in Two Years

In the latest developer meaning, it was unanimously decided that the difficulty adjustment be activated after 4 million blocks, or roughly after two years anytime in 2020/2021. At the same time, the Proof-of-Stake, Beacon Chain will be active in mid-2020.

By the time of the hard fork, the network’s coin inflation will rise by 2,000 ETHs to around 13,600. The name of the Difficulty Bomb activating hard fork has been christened, Mountain Glacier.

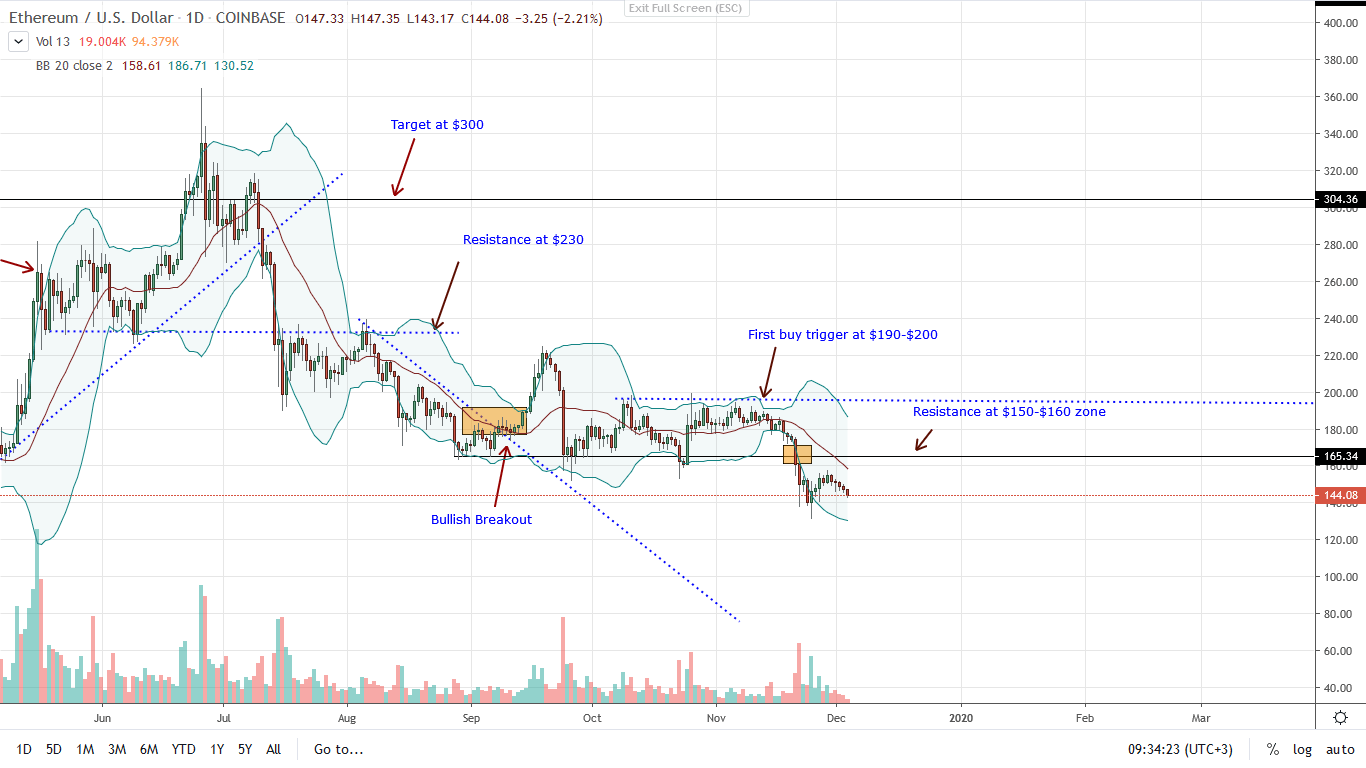

ETH/USD Price Analysis

ETH prices are flat on a week-to-date basis. Mildly gaining against the greenback, it is down relative to BTC. However, from candlestick arrangement, there is hope for bulls.

Observed, ETH price is fluctuating inside Nov 25 and notably inside the bearish Nov 23 candlestick. This state of consolidation in smaller time frames mean traders are held at a flux, cognizant that sellers have the upper hand in the short to medium term.

The break below $150-60 support, now resistance, zone set the pace for sellers and unless there is a sharp reversal and close above $160, ETH could slide back to $130 and worse $100 in days to come.

For bull traders, patience is key. Once there is a total reversal of Nov 23 losses and a three-bar bullish reversal pattern prints at the back of decent trade volumes-preferably exceeding 200k, odds are prices will rally to $180 and later $200. Conversely, bear trend continuation that sees ETH drop below $130 could mark the beginning of further declines towards $100 or worse, 2018 lows of $70.

Chart courtesy of Trading View-Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.

The post Ethereum [ETH] Price Analysis: Prices Suppressed, Difficulty Bomb Adjustment Pushed by 2 Years appeared first on Crypto Economy.